- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

はじめに

ロケットの打ち上げを想像してみてください。スムーズな離陸、正確なタイミング、明確な軌道を確保するためには、堅牢な発射台が必要です。ブロックチェーンの世界では、暗号資産の発射台は企業にとって同様の役割を果たし、資金調達、トークンの配布、市場への露出といった必要不可欠な機能を提供することで、Web3プロジェクトが勢いを増し、成功を収めるのをサポートします。このブログでは、暗号資産ローンチパッドのコンセプトを掘り下げ、2025年の暗号資産ローンチパッドトップ5を発表する。

暗号資産ローンチパッドとは?

暗号資産ローンチパッドは、Web3ビジネスの初期段階を支援する専用プラットフォームです。新しいプロジェクトと潜在的な投資家をつなぐ重要な架け橋となります。

ベンチャーキャピタルや新規株式公開(IPO)のような従来の資金調達方法とは対照的に、暗号資産ローンチパッドでは、プロジェクトがトークン販売を通じて資金を調達できます。このアプローチは投資機会を多様化し、幅広い投資家が有望なプロジェクトに最初から投資することを可能にします。一方、従来の手法では、参加する投資家が一部の認定投資家に限定されることが多く、小規模な投資家が参加することは困難でした。

ローンチパッドは、長時間のデューデリジェンスや不透明な取引を伴うことが多い従来の資金調達方法とは異なり、厳格な審査手続きを採用することで、スタートアップ企業や投資家にとって安全で透明性の高い環境を作り出しています。また、従来の資金調達手段では不足しがちな、マーケティング支援やコミュニティへの参画など、必要不可欠なリソースやサポートサービスも提供しています。このような包括的なサポートは、急速に進化する状況の中でプロジェクトを成功に導く可能性を大幅に高めます。

📌 暗号資産ウォレットの5つのタイプに興味があるかもしれません。

暗号資産ローンチパッドの主な機能

資金調達モジュール

暗号資産ローンチパッドには、トークンセール、プレセール、クラウドファンディングキャンペーンを組織・実行するためのモジュールが含まれています。これらのモジュールは、価格設定や資金調達目標などのカスタマイズ可能なパラメータを提供し、ブロックチェーンプロジェクトの資金調達プロセスを合理化します。

トークンの割り当てとベスティングシステム

統合された割当システムは、オートマティック ベスティングのスケジュール、タイムロックされたトークンのリリース、動的な割当設定などの機能により、投資家へのトークンの分配を管理します。これらのシステムは安全かつ公平なトークン管理を保証し、企業の管理オーバーヘッドを削減します。

📌 もっと読む:トークン ベスティング

マルチブロックチェーンの統合

ローンチパッドは複数のブロックチェーンネットワークをサポートする機能を備えており、Web3プロジェクトが目標に最も合致したエコシステムを選択できるようになっています。これには、Ethereum、Binance Smart Chain、Solanaなどの主要なブロックチェーンとの互換性が含まれ、柔軟性と相互運用性を保証します。

KYC/AMLコンプライアンスツール

規制要件に対応するため、ローンチパッドにはKYC(Know Your Customer)とAML(Anti-Money Laundering)チェックを実施するためのツールが組み込まれています。これらのツールは、安全なデータの取り扱いを提供し、すべての参加者が法的およびセキュリティ基準を満たしていることを保証します。

マルチ ティア ステーキング モジュール

多くのローンチパッドには、投資家が保有するステークに基づいて分類されるマルチ ティア ステーキングシステムが含まれています。このシステムにより、企業はハイティアの参加者を優先的にトークンの独占割り当てや早期アクセスに割り当て、独占感を醸成し、熱心な投資家に報いることができます。

流動性プールの自動化

ローンチパッドは多くの場合、ローンチ時にトークンの流動性を即座に確保するためのオートメイティド流動性プールメカニズムを統合しています。これらのツールは、トークンを安定コインや他の暗号資産とペアリングすることでトークン市場を安定させ、シームレスな取引機会を提供し、投資家の信頼を高めるのに役立ちます。

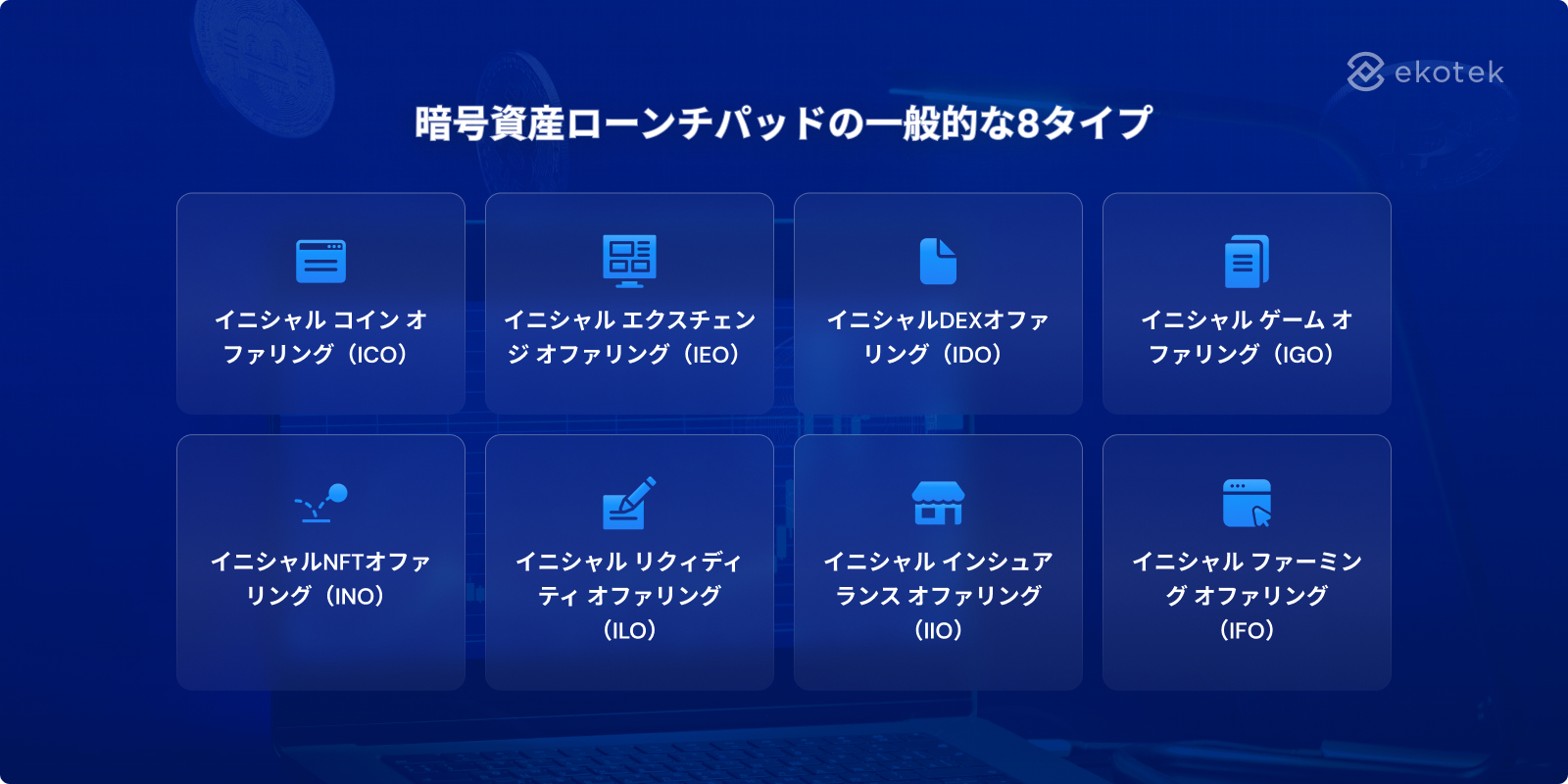

暗号資産ローンチパッドの一般的な8タイプ

暗号資産ローンチパッドの一般的な8タイプ

イニシャル コイン オファリング(ICO)

イニシャル コイン オファリング(ICO)は、ブロックチェーンを利用した資金調達の原型となるモデルです。ICOは、企業がトークンを発行・販売することで、一般の人々から直接資金を調達することを可能にします。ICOはシンプルで仲介者がいない反面、詐欺や規制当局の監視といったリスクを軽減するための強力な透明性対策が必要となります。

イニシャル エクスチェンジ オファリング(IEO)

IEO(Initial Exchange Offering)では、暗号資産取引所がトークン販売を促進し、コンプライアンスを確保し、プロジェクトの信頼性を検証します。このモデルは、事業者に取引所のユーザーベースへのアクセスを提供し、トークン上場を合理化することで、投資家の信頼を高めます。

イニシャルDEXオファリング(IDO)

イニシャルDEXフェリング(IDO)は、トークンセールをホストするために分散型取引所を利用します。これらのプラットフォームにより、企業は仲介業者をバイパスして、即時流動性のあるトークンをローンチできます。IDOは分散化を優先するプロジェクトには理想的ですが、価格変動やセキュリティ上の懸念といった課題に直面する可能性があります。

イニシャル ゲーム オファリング(IGO)

イニシャル ゲーム オファリング(IGO)は、ブロックチェーンゲームプロジェクト向けに調整されています。ゲーム内アセットやトークンを提供することで資金調達を可能にし、ゲームファンを惹きつけ、コミュニティへの関与を促進します。

イニシャルNFTオファリング(INO)

イニシャルNFTオファリング(INO)は、ノン ファンジブル トークン(NFT)の立ち上げと販売を専門としています。INOは、アートやエンターテイメントのような業界に最適で、デジタル コレクティブルを通じてオーディエンスを魅了しながら、クリエイティブな資金調達オプションをビジネスに提供します。

イニシャル リクィディティ オファリング(ILO)

イニシャル リクィディティ オファリング(ILO)は、流動性プールトークンを提供することによる資金調達に焦点を当てています。企業はこのモデルを活用することで、分散型取引を促進しながら即時流動性を確保できます。

イニシャル インシュアランス オファリング(IIO)

イニシャル インシュアランス オファリング(IIO)は、保険関連のブロックチェーン プロジェクトに対応しています。これらのプラットフォームは、企業が分散型保険プロトコルに結びついたトークンを提供することで資金調達を可能にし、成長するニッチ市場に対応します。

イニシャル ファーミング オファリング(IFO)

イニシャル ファーミング オファリング(IFO)は、分散型金融(DeFi)領域をターゲットとしており、トークンセールとイールド ファーミング メカニズムを統合することで、企業が資本を調達することを可能にしています。このアプローチは、利益と積極的な参加の両方を求める投資家にアピールします。

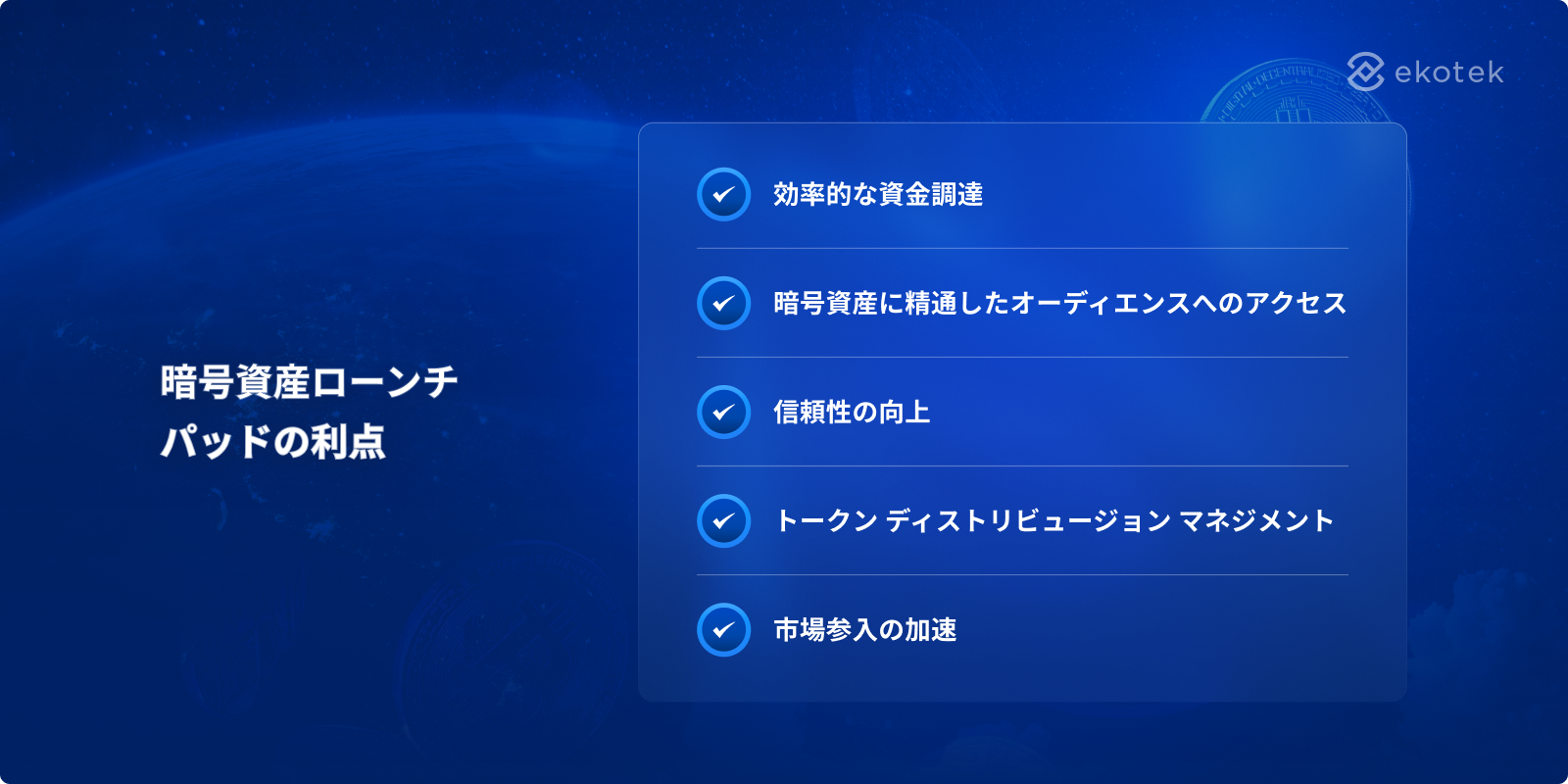

暗号資産ローンチパッドの利点

暗号資産ローンチパッドの利点

効率的な資金調達

暗号資産ローンチパッドは、プロセスを合理化し、よりアクセスしやすくすることで、資金調達に革命をもたらします。従来の資金調達は、複雑な規制のハードル、膨大な書類、時間のかかる承認プロセスを伴うことが多いものでした。対照的に、ローンチパッドはシンプルなフレームワークを提供し、企業は世界中のオーディエンスに迅速にプロジェクトを発表できます。

仲介者を排除し、諸経費を削減することで、ローンチパッドは、企業が資金調達プロセスをナビゲートすることを大幅に容易にします。 この合理化されたアプローチにより、企業はプロジェクトの開発や潜在的な投資家との関わり合いに時間とリソースを集中できます。その結果、スタートアップ企業や小規模ベンチャー企業は、資金調達のスケジュールを早め、効果的に規模を拡大するために必要な資金を確保できます。

📌 エコテックが投資の壁を破る暗号資産ローンチパッドをどのように提供したかを紹介します。

暗号資産に精通したオーディエンスへのアクセス

暗号資産ローンチパッドを利用するユニークな利点の1つは、暗号資産に精通した投資家のコミュニティに即座にアクセスできることです。これらの人々はブロックチェーン技術に精通しているだけでなく、支援する革新的なプロジェクトを積極的に探しています。企業にとって、これはブロックチェーンの可能性を理解し、その未来に投資する意思を持つオーディエンスの間で知名度を得ることを意味します。このようにターゲットを絞った露出を行うことで、資金調達の目標達成の可能性を大幅に高めると同時に、熱心で知識豊富な支援者との長期的な関係を育むことができます。

信頼性の向上

ほとんどの評判の良いローンチパッドは、ホストするプロジェクトを審査するために厳格なデューデリジェンスを行っており、合法的で有望なベンチャーだけが紹介されるようにしています。この審査プロセスにより、潜在的な投資家は、プロジェクトが徹底的に評価されたことを信頼でき、信用を深めることができます。信頼できるプラットフォームとの結びつきは強力な裏付けとなり、より多くの関心を集め、ビジネスの将来の成長のための強固な基盤を築けます。

トークン ディストリビュージョン マネジメント

トークン ディストリビュージョンの効率的な管理は、ブロックチェーン プロジェクトを成功させる上で重要な側面です。暗号資産ローンチパッドは、投資家へのトークンの割り当て、ベスティングのスケジュール管理、規制要件へのコンプライアンスの確保など、複雑な分配タスクを処理するための組み込みツールを提供します。これらのツールはプロセスをシンプルに、エラーのリスクを低減し、透明性を高めます。これらの機能を活用することで、企業は運営上の課題にとらわれることなく、戦略的な成長に集中できます。

📌 もっと読む:RWAトークンとは? 成功したRWAプロジェクトトップ9

市場参入の加速

準備の整ったインフラ、マーケティング支援、投資家の膨大なネットワークへのアクセスを提供することで、ローンチパッドは事業の立ち上げを可能にします。トークンの作成から取引所への上場まで、すべてのプロセスが迅速化されるため、プロジェクトは不必要な遅延なく市場機会を活用できます。競争力の獲得を目指す企業にとって、この加速されたタイムラインは、暗号資産エコシステムにおいて足場を確立し、牽引力を得る上で大きな違いを生む可能性があります。

2025年 暗号資産ローンチパッド プラットフォーム トップ5

2025年 暗号資産ローンチパッド プラットフォーム トップ5

Binance Launchpad

Binance LaunchpadはIEOであり、暗号資産業界で最も認知されたプラットフォームの1つで、その広範なユーザーベースとプロジェクト立ち上げの成功実績で有名です。

OKX Jumpstart

OKX Jumpstartは、取引所への正式上場に先立ち、ユーザーが革新的なプロジェクトからトークンを取得できるローンチパッド プラットフォームとして機能するIEOです。

Phemex Launchpad

Phemex Launchpadはサブスクリプション ベース モデルを採用しており、ユーザーはアカウントにステーブルコインを保有することで参加し、割り当てを受けることができます。

DAO Maker Launchpad

DAO Makerは、IDOを通じて新しい暗号資産スタートアップの資金調達をお手伝いするために設計されたローンチパッド プラットフォームです。

Polkastarter

Polkastarterは、クロスチェーンのトークンプールと分散型資金調達のための最高の選択肢であり、ブロックチェーンチームや企業がPolkadot ネットワーク上で初期資金を確保し、一般にプロジェクトを立ち上げることを可能にします。

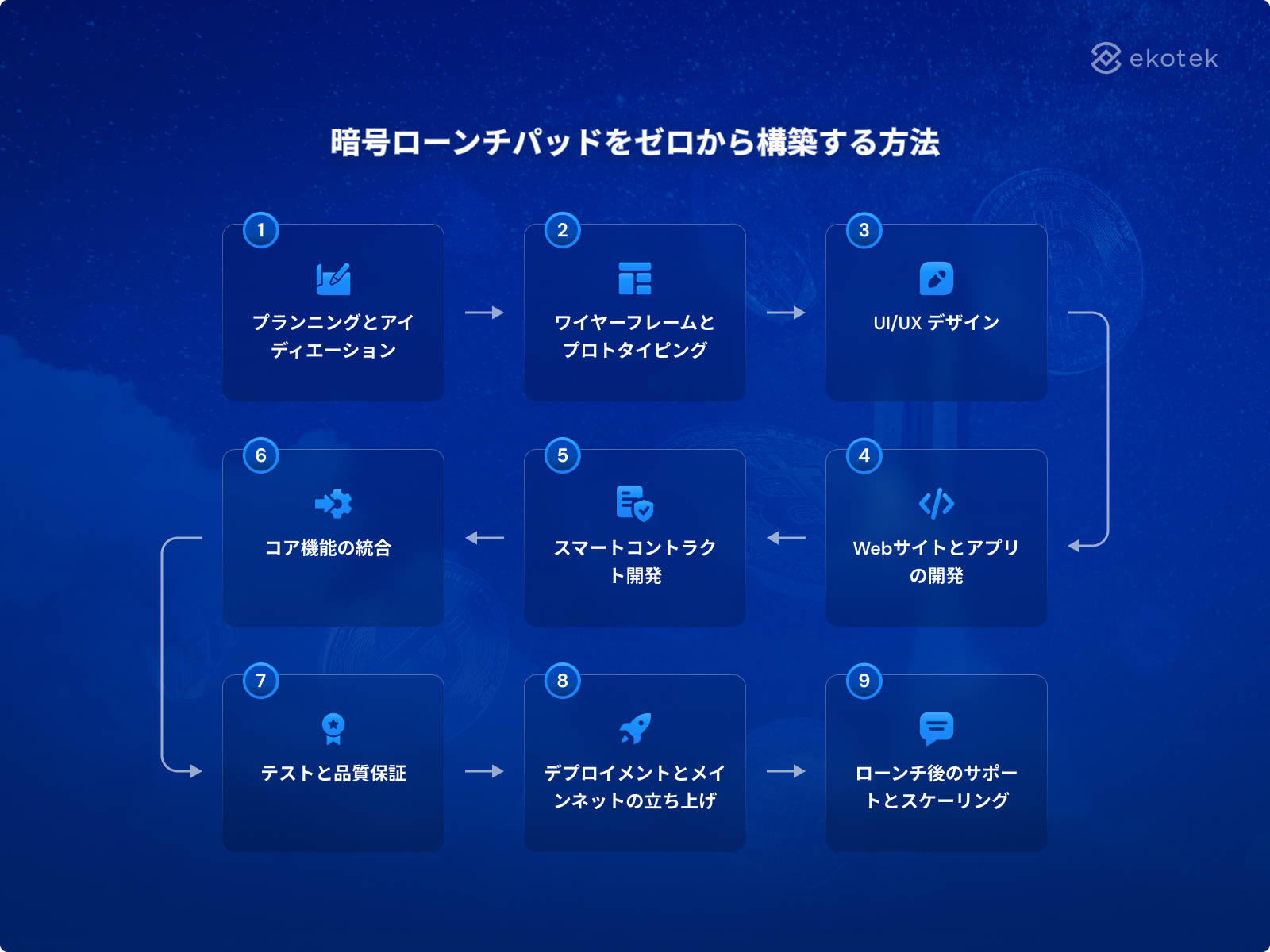

暗号ローンチパッドをゼロから構築する方法

プランニングとアイディエーション

暗号資産ローンチパッドを構築する最初のステップは、ビジネスゴールとターゲットオーディエンスを明確に理解することです。ICO、IDO、NFTのどれに重点を置くのか? 必要な主要機能を特定し、ステークホルダーと協力してロードマップを作成し、ローンチパッドを際立たせるために必要な機能に優先順位を付けましょう。

ワイヤーフレームとプロトタイピング

明確なプランができたら、ワイヤーフレームとプロトタイプを作成し、プラットフォームの構造とユーザージャーニーを視覚化します。この段階は、ユーザーダッシュボード、トークン販売ページ、管理パネルなどのコア機能をマッピングするのに役立ちます。プロトタイプを作成することで、反復的なフィードバックが可能になり、開発を開始する前にビジョンとユーザーの期待の整合性を確保できます。

UI/UX デザイン

ブランド アイデンティティを反映した、直感的で視覚に訴えるデザイン。ユーザーフレンドリーなナビゲーション、レスポンシブレイアウト、魅力的なインターフェイスを重視し、ユーザーエクスペリエンスを高めます。

Webサイトとアプリの開発

デザインが確定したら、プラットフォームのバックエンドのコーディングを開始し、ユーザー登録、KYC/AMLコンプライアンス、トークン管理などの重要なプロセスを処理します。デバイス間でシームレスなインタラクションを実現するために、堅牢なフロントエンドを開発します。アプリがローンチパッドの一部である場合は、Webサイトとスムーズに統合され、主要な機能をサポートしていることを確認します。

📌 もっと読む:アプリ開発のアウトソーシングとその仕組み

スマートコントラクト開発

トークンの配布、ベスティングのスケジュール、ステーキング報酬などのプロセスを自動化するために、安全で効率的なスマートコントラクトを開発します。これらのコントラクトの厳密なテストは、脆弱性を防ぎ、円滑な取引を保証するために不可欠です。

コア機能の統合

マルチティア ステーキングモジュール、オートメイティド流動性プール、マルチブロックチェーンサポートなどの必須機能を組み込みます。これらのコンポーネントはプラットフォームの機能性を高め、多様なプロジェクトや投資家を惹きつけます。

テストと品質保証

バグを特定し解決するための徹底的なテストを実施し、プラットフォームが様々な条件下で最高のパフォーマンスを発揮することを保証します。スマートコントラクトからユーザーインターフェースまで、すべての機能をテストし、スムーズなローンチを保証します。

デプロイメントとメインネットの立ち上げ

プラットフォームがすべてのテストフェーズを通過したら、メインネットにデプロイします。このステップでは、ローンチパッドを完全に稼働させ、一般ユーザーがアクセスできるようにします。ローンチ後のサポートは、パフォーマンスを監視し、新たな問題に対処し、必要に応じてアップデートを実施するために極めて重要です。

ローンチ後のサポートとスケーリング

ローンチ後も、ユーザーからのフィードバックや市場動向に基づいて、プラットフォームの改良と拡張を続けてください。技術サポートを提供し、機能アップデートを展開し、新しいブロックチェーンエコシステムに進出する機会を探ります。効果的にスケーリングすることで、競争の激しい暗号資産空間における長期的な成功と関連性を確保できます。

ブロックチェーンとソフトウェア開発のクラッチ認定リーダーとして、エコテックはdApps、NFTマーケットプレイス、DEX、CEX、暗号資産ローンチパッドなど、最先端のWeb3アプリケーションの作成に関する幅広い専門知識を提供しています。エコテックのホワイトラベルソリューションでは、お客様それぞれのニーズに合わせて機能をカスタマイズし、カスタムローンチパッドを迅速かつ合理的に構築するお手伝いをいたします。お客様のプロジェクトを次のレベルに引き上げるためのパーソナライズされたガイダンスとサポートについては、私たちのブロックチェーンの専門家に今すぐお問い合わせください。

まとめ

まとめ

した。資金調達を合理化し、信頼性を高め、市場参入を加速させるこれらのプラットフォームは、ブロックチェーン分野で成功を目指す企業にとって不可欠です。適切なローンチパッドを選択することで、企業は比類のない成長機会を引き出し、暗号資産エコシステムにおいて永続的なインパクトを与えることができます。

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8